Mapping the investment potential of climate-smart business in the EMENA region

Key findings from our report prepared with A.T. Kearney for the International Finance Corporation

E Co. has completed a market assessment report for the International Finance Corporation (IFC) in collaboration with A.T. Kearney. The report was delivered in Istanbul at the Investing in Climate Business Forum for private sector executives held in collaboration with the Financial Times. The topic: Mapping the Investment Potential of Climate-Smart Business in the EMENA region.

What is Climate Business?

The IFC estimates that 80% of the investment needed to prevent further climate change will need to come from the private sector. This means that stimulating “climate business” (companies focused on areas such as the sustainable management of energy, water, and other natural resources) will be essential to reduce the risk to our global future.

Why is EMENA such a key region for such investments and why are they attractive to private investors?

The countries in the regions of Emerging Europe, Central Asia, the Middle East, and North Africa, dubbed EMENA by the IFC, hold more than half the world’s oil and three-quarters of its gas. The region has similar energy consumption and carbon emission levels to North America but with 35% lower GDP, making it one of the world’s most energy inefficient regions.

Currently, the region is facing surges in energy demand, along with many areas facing population growth and urbanisation. Combined with a historic lack of underinvestment, countries in this region are facing real and urgent demand for infrastructure improvements and to improve the efficiency of their industrial, transport, and utility sectors.

In addition, effects of climate change such as land surface change and water scarcity are predicted to strongly impact much of the region.

How is this translating into investment activity?

Shrewd investors are already capitalising on the region’s remarkable potential. Renewable energy investment grew 40% to $2.9 billion in 2012 in the Middle East and North Africa (MENA) countries, and has exceeded 100% across the Balkans and Eastern Europe. Capital inflows in the power generation and industrial sectors of Russia and Kazakhstan are higher than ever before.

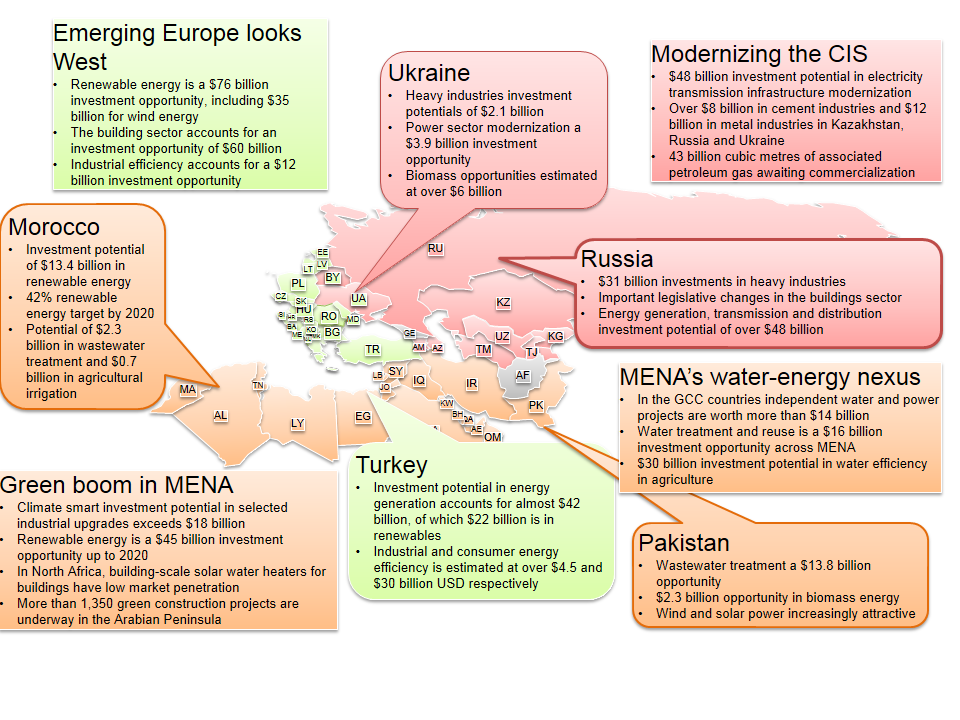

Given these positive developments, the report gives an estimated potential for climate-smart investments of almost $1 trillion by 2020. This number assumes significant reductions in energy-subsidies and a series of ambitious reforms and incentive schemes.

What are the major regional trends?

E Co. focused the report on four key trends:

1. Green boom in the MENA region

- In the face of rapid population growth and rapid urbanisation, countries in the Middle East and North Africa are actively diversifying their energy supply, primarily by boosting renewable energy and energy efficiency.

- Potential: Over $192 billion of climate-smart investment opportunities in a range of sectors, including around $45 billion in renewable energy ($29 billion in solar and $12 billion in wind).

2. Modernising the CIS

- In the Commonwealth of Independent States (CIS), the vast majority of infrastructure pre-dates 1990 and is highly inefficient. Programs of modernisation have been launched, meaning climate-smart business opportunities are emerging.

- Potential: Modernising and replacing outdated equipment could yield over $192 million of opportunities.

3. Emerging Europe looks West

- From the Baltic to the Balkans, growing EU integration is encouraging greater openness to foreign direct investment due to factors such as alignment with European policy.

- Potential: More than $232 billion by 2020, of which the building sector could account for $36 billion and renewable energy for $76 billion ($35 billion for wind, $18 billion for solar, and $12 billion for biomass).

4. MENA’s energy-water nexus

- In the water-strained MENA countries, it is clear that where energy and water are concerned, investment opportunities can be found.

- Potential: Water and power projects such as solar desalination are on the rise, with over $13.5 billion of projects in Saudi Arabia, Kuwait and the UAE alone.

The report was given local context by focusing a Country Spotlight on five distinctive case studies:

1. Turkey the Mediterranean Tiger

2. Russia’s Green Awakening

3. Ukraine’s Growing Pains

4. Pakistan’s Climate Resilient Ambitions

5. Morocco’s Big, Fast and Green Expansion

Contact us to discuss your own market assessment needs.