36th Meeting of the GCF board project approvals, supported by E Co.

13 July 2023, Category: All insights, News, Tags: &Green, climate finance, gcf, GCF B.36, Green Climate Fund, MCT

At the 36th Meeting of the Green Climate Fund Board (GCF B.36), two projects developed by teams here at E Co. were approved by the GCF Board. These two projects will go towards developing climate resilience in a variety of locations across the globe, from small island states in the Pacific to forests across Africa, Latin America, and the Caribbean.

At GCF B.36, a total of 12 funding proposals were presented for consideration. USD 755.8 million of GCF funding was requested within these proposals, increasing to USD 3.185 billion with co-financing. Eight of these proposals were adaptation-themed, and four were cross-cutting.

The E Co. team supported the development of two projects, project FP212 and project SAP029, which we are exploring below.

- Ecosystem-based Adaptation (EbA) for Reducing Community Vulnerability to Climate Change in Northern Pacific Small Island Developing States (SIDS)

- &Green Fund: Investing in Inclusive Agriculture and Protecting Forests

Background on B.36

Before GCF B.36 had begun in earnest, the GCF had originally endorsed 14 funding proposals – with an extra two cross-cutting projects and a GCF funding value requested of USD 910.3 million. Five of these proposals came from direct access entities (DAEs). Another five received support from the GCF’s Project Preparation Facility, three DAE projects and two from international access entities (IEAs).

All of these 14 proposals were then submitted to the independent Technical Advisory Panel (iTAP) for assessment. Of these 14 proposals, two were not endorsed by the iTAP – one private sector funding proposal from an IAE and one private sector funding proposal from a DAE – as they were both seen to have a low potential impact, amongst other negative assessments.

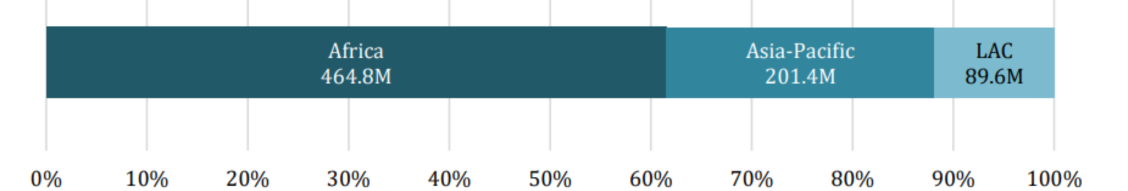

Figure 1. Regional distribution of GCF funding (in USD)

When it comes to how the funding is being distributed among vulnerable countries, 11 of the 12 funding proposals present at GCF B.36 either fully or partially target least developed countries (LDCs), Small Island Developing States (SIDS), and African states, which account for 82 percent of the total funding value requested from the GCF.

You can find out more about the background of B.36’s funding proposals in the B.36 ‘Consideration of funding proposals’ document.

Ecosystem-based Adaptation (EbA) for Reducing Community Vulnerability to Climate Change in Northern Pacific Small Island Developing States (SIDS)

Total project value – USD 981.6m

Tonnes of emissions avoided – 339.2m

Total beneficiaries – 26.6m

Theme – Cross-cutting

Around the Pacific and particularly within the Micronesian archipelago, communities heavily rely upon the biodiversity and ecosystem services provided by the coastal and marine ecosystems prevalent in these areas. From food security to flood management, coastal communities benefit from the myriad services offered by the continued good health of these ecosystems. To combat the issues of climate change, ecosystem-based adaptation (EbA) must be scaled in order to adequately prepare for a future in which climate shocks are uneven, intense, and difficult to overcome.

This project works by establishing small-grant facilities in Micronesia, Palau, and the Marshall Islands. Using these facilities, it will integrate with locally-led- EbA initiatives, providing finance and building capacity. This is all intended to lead to the utilisation of the current best EbA practices by the local communities that need them the most.

The E Co. team worked on this project directly for the project AE, the Micronesia Conservation Trust (MCT). Our main objective was to prepare a full GCF Funding Proposal, and included several key steps:

- Increasing technical capabilities of NGOs and local authorities to address relevant climate change threats;

- Providing a funding mechanism through a Small Grants Facility to implement local adaptation projects within protected areas and natural habitats;

- Developing a program to ensure the sustainability of coalitions to upscale knowledge management systems, promote regional cooperation, and capture lessons learned from sub-project implementation; and to develop a sustainable a sustainable financing mechanism which will enhance the upscale and replication of the results achieved from the grant mechanisms and build on the Micronesia Challenge Business Plan to ensure a sustainable financing plan is developed.

The E Co. team was able to successfully deliver these results, which has resulted in a full endorsement and approval by the GCF. From now on, this programme will look to build on the successful interventions currently utilised in the region, such as:

- The Micronesia Challenge;

- The Pacific Ridge to Reef (R2R) programme;

- The Adaptation Fund project ‘Enhancing the Climate Resilience of vulnerable island communities in the Federated States of Micronesia’.

Find out more about this project here.

&Green Fund: Investing in Inclusive Agriculture and Protecting Forests

Total project value USD – 9.9m

Tonnes of emissions avoided – TBD

Total beneficiaries – 76.4k

Theme – Adaptation

Tropical forests account for 1.2 billion hectares of land. They are arguably the largest and most complex hotspots for biodiversity on Earth, but also represent a huge chunk of carbon reservoirs that exist today. If no protections are enacted for these areas and their ecosystem services are allowed to break down, negative impacts that are cascading and self-reinforcing will come about through climate change, leading to biodiversity loss, increased carbon emissions, and forest degradation – amongst other drastic consequences.

The second project approved at GCF B.36 was FP212. Project FP212, also known as the &Green Fund, is a thematic investing fund that looks to decouple deforestation from major commodity supply chains, promoting sustainable production and improved agricultural productivity. The aim of this is to target countries that play host to tropical forests, and by improving production across the aforementioned areas, reduce the need for clearing these important biodiversity hotspots.

The &Green Fund will also work to reduce emissions and increase the climate resilience of local communities, through moving agricultural commodity supply chains from extractive production methods to sustainable ones.

Investments include those targeting zero-deforestation, and sustainable and regenerative agriculture. The Fund launched in 2017 and currently has approximately USD 100 million under management, with key investors including Norway, FMO, Unilever, and the Global Environment Facility (GEF). The involvement of the GCF will catalyse significant financial flows into the Fund to meet the USD 1 billion goal.

So where does E Co. come in? Overall, the team of consultants assigned to this project successfully delivered several key deliverables:

- Conducted a gap analysis of existing &Green documentation within an exploratory assessment of &Green’s requirements in relation to those of the GCF;

- Real-time consultations and briefings with fund managers;

- The facilitation of information meetings with key GCF Secretariat staff;

- The preparation of the GCF Concept Note – including a Theory of Change, the project baseline and context, outputs and activities, and budgeting;

- The preparation and delivery of the GCF funding proposal;

- Advised on stakeholder engagement;

- Support through the mandatory rounds of GCF assessment (such as iTAP).

Find out more about this project here.

Climate finance is much larger than GCF B.36 – stay in touch to find out more

Looking for insight into climate finance? Look no further

Get in touch with our climate finance consultants to discuss a project you’re working on and create successful, fit-for-purpose projects, now and in the future. Email us at: amy@ecoltdgroup.com or find us at the following:

Twitter: @ecoltdnews

LinkedIn: E Co.

Instagram: @ecoltdnews

Figures

- Green Climate Fund, 2023. Consideration of Funding Proposals. Available at: https://www.greenclimate.fund/sites/default/files/document/gcf-b36-02.pdf

Join the conversation by posting a comment below. You can either use your social account, by clicking on the corresponding icons or simply fill in the form below. All comments are moderated.